In the dynamic global business landscape, joint ventures have emerged as a crucial strategy for businesses aiming to expand their reach, share risks, and leverage local expertise. Japan’s joint ventures (JVs) are particularly significant due to the country’s unique market characteristics and regulatory environment.

Why Do You Need a Joint Venture Agreement?

A joint venture agreement is essential for businesses looking to enter the Japanese market due to several key reasons:

- Market Access: A JV provides a structured pathway for easier entry into the Japanese market, leveraging the local partner’s established presence and networks.

- Local Knowledge: Collaborating with a local partner allows foreign businesses to benefit from the partner’s deep understanding of the Japanese market, culture, and regulatory environment.

- Risk Sharing: Sharing the risks and costs associated with market entry and operations reduces the burden on individual partners and fosters a collaborative approach to problem-solving.

- Resource Sharing: Partners can combine resources, including financial assets, technology, and human capital, to enhance operational efficiency and innovation.

Types of Joint Venture Agreements

Equity Joint Ventures

In an equity joint venture, the partners create a new entity in which they both invest and share ownership. This type of JV involves a more permanent and structured relationship. Each partner holding equity stakes proportional to their investment. The new entity operates as an independent business, with profits and losses shared according to the ownership percentages.

Contractual Joint Ventures

A contractual joint venture does not involve creating a new entity. It is based on a contractual agreement where the partners collaborate on a specific project or for a defined period. This type of joint venture is more flexible and can be tailored to the partners’ specific needs and goals. It is often used for short-term projects or specific objectives. We will mainly focus on Equity Joint Ventures throughout this article.

Advantages of Joint Ventures in Japan

Market Entry

- Facilitates Easier Entry: A JV allows foreign companies to enter the Japanese market more seamlessly by leveraging the local partner’s established market presence and customer base. To make your market entry even smoother, download our free market entry e-book, packed with essential insights and strategies.

- Local Market Knowledge: The local partner’s understanding of market dynamics, consumer behavior, and regulatory requirements is invaluable for navigating the complexities of the Japanese market.

- Networking Opportunities: Collaborating with a local partner opens up access to their network of contacts, including suppliers, distributors, and regulatory bodies

Resource Sharing

- Combined Expertise: JVs enable the pooling of resources, expertise, and technologies from both partners, fostering innovation and operational efficiency.

- Cost and Risk Sharing: Partners share the financial burden and risks associated with the joint venture, making it a more sustainable and less risky venture.

Innovation and Growth

- Access to New Technologies: Collaborating with a partner can provide access to cutting-edge technologies and innovative practices, enhancing the JV’s competitive edge. To learn more about innovation and growth in Japan

- Expansion Opportunities: A successful joint venture can serve as a springboard for further expansion within Japan and into other markets, leveraging the strengths and capabilities of both partners.

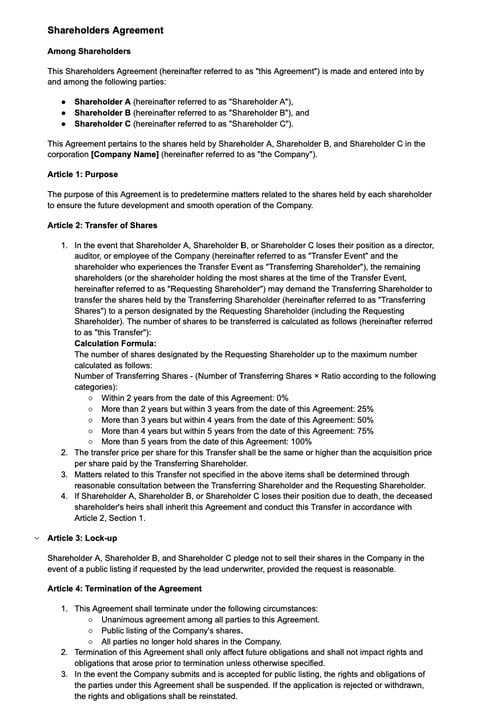

Difference between Joint Venture Agreement (合弁契約) vs Shareholders Agreement (株主間契約)

In Japan, both joint venture agreements and shareholders agreements are essentially the same and serve overlapping purposes:

- Joint Venture Agreement (合弁契約): This agreement outlines the terms and conditions for the formation, operation, and dissolution of a joint venture, including each partner’s objectives, contributions, and responsibilities. It also governs the relationships between the joint venture’s shareholders.

- Shareholders Agreement (株主間契約): This agreement similarly governs the relationships between shareholders, detailing their rights, responsibilities, and obligations, and often includes provisions on share transfers, voting rights, and dividend policies.

Thus, in Japan, people often treat joint venture agreements and shareholders agreements as interchangeable due to their overlapping nature and purposes.

Steps to Form a Joint Venture in Japan

Initial Discussions and Partner Selection

The first step in forming a joint venture (JV) in Japan involves initial discussions and careful partner selection. This phase is critical, as the choice of partner can significantly impact the venture’s success. Start by evaluating potential partners for compatibility. It is essential to ensure that the partners align in terms of vision, goals, and complementary strengths. A successful JV relies on a shared strategic direction and mutual respect, making this alignment crucial.

Once compatibility is established, both parties should clarify their mutual objectives and long-term strategies. Thisensures that both parties are working towards the same outcomes and clearly understand each other’s expectations. It is also important to draft and sign confidentiality agreements during these discussions. These agreements protect sensitive information exchanged during negotiations, helping to build trust and safeguard proprietary information.

Conduct Due Diligence

After initial discussions, conducting thorough due diligence is imperative. This process involves a detailed examination of potential partners’ financial health, legal standing, and operational capabilities.

Financial Assessment: Analyze potential partners’ financial statements, credit history, and any existing liabilities. This helps assess their financial stability and reliability. Understanding a partner’s financial health is crucial to ensuring they can meet their financial commitments and support the JV’s objectives.

Legal Standing: Check for ongoing litigations or legal disputes that could impact the JV’s operations or reputation. It is essential to ensure that the potential partner is not embroiled in legal issues that could pose risks to the JV.

Operational Capabilities: Assess the partner’s facilities, technology, and workforce to ensure they have the necessary capabilities to contribute effectively to the JV. Review the partner’s track record by examining past performance, client testimonials, and market reputation. This helps gauge the partner’s reliability and business ethics, providing insights into their operational effectiveness and market standing.

Draft the Joint Venture Agreement

After conducting due diligence, draft a comprehensive joint venture agreement. The agreement should clearly define the JV’s purpose, goals, and activities. It should also specify the amount and type of investment each party will provide, including cash, assets, and services.

Outline the JV’s governance structure, detailing the board of directors, executive roles, and decision-making processes. This structure helps manage the JV effectively and ensures smooth operations. Additionally, it details how profits and losses will be allocated between partners, providing a clear financial framework for the JV.

Establish conflict resolution and termination procedures, including conditions for resolving disputes and buyout options. This ensures that the JV can handle conflicts efficiently and has a clear exit strategy.

For a more detailed understanding, you can refer to the fully translated example of a joint venture agreement in the following Google Doc.

Obtain Regulatory Approvals

The final step involves obtaining the necessary regulatory approvals to operate the JV legally in Japan. Compliance with Japanese laws and regulations is crucial. Ensure that the JV adheres to relevant local laws, including antitrust regulations and foreign investment rules.

Filing Documents: Prepare and file essential documents, such as the Articles of Incorporation, which detail the JV’s structure, objectives, and operational guidelines. Register the JV with the appropriate local government office and provide documentation of each party’s capital contributions. If the JV involves foreign capital, notify the relevant authorities as required under the Foreign Exchange and Foreign Trade Act. Read more on Japanese legal requirements.

Tax Considerations for Joint Ventures in Japan

When establishing a joint venture in Japan, several tax considerations must be taken into account to ensure compliance and optimize financial outcomes:

Corporate Taxation: JVs are subject to corporate tax on their profits. Unlike some jurisdictions, Japan does not offer pass-through taxation for joint ventures. The JV itself will be taxed on its earnings before profits are distributed to the partners.

Transfer Pricing: Transactions between the JV and its parent companies must adhere to transfer pricing regulations to ensure that prices are set at arm’s length. This prevents tax evasion through the manipulation of transfer prices.

Thin Capitalization Rules: These rules limit the deductibility of interest expenses if the JV is funded excessively through debt from a foreign parent company. To mitigate this, the debt-to-equity ratio should be managed carefully.

Consumption Tax (VAT): Joint ventures selling goods and services must register for and comply with Japan’s consumption tax requirements. This includes charging the correct VAT rates on sales and ensuring timely and accurate filing of VAT returns. Non-compliance can lead to penalties, making it crucial for the JV to understand and adhere to these regulations.

Withholding Tax: Payments made by the joint venture to foreign partners, such as dividends, interest, and royalties, may be subject to withholding tax. Tax treaties between Japan and the partner’s home country can influence the rates and applicability of withholding tax. It is important to review these treaties to optimize the tax position and avoid double taxation.

Tax Incentives: Tax incentives may be available depending on the nature of the joint venture’s activities. For example, Japan offers various credits or deductions for research and development expenditures. Identifying and taking advantage of these incentives can significantly reduce the tax burden and improve the JV’s financial performance. Proper tax planning and consulting with tax professionals are essential to navigating these complexities. By understanding the tax landscape and proactively managing tax obligations, JV partners can optimize their financial outcomes and ensure compliance with Japanese tax laws. Read more about tax credits and deductions.

Conclusion

Forming a joint venture in Japan involves a detailed and structured process, starting from initial discussions and partner selection to conducting thorough due diligence, drafting a comprehensive joint venture agreement, obtaining necessary regulatory approvals, and managing tax considerations. Each step requires careful planning and execution to ensure the venture’s success. By following these steps, foreign and local entrepreneurs can create a strong foundation for their joint venture, leveraging the combined strengths of both partners to achieve their business objectives. The collaborative nature of joint ventures allows for shared resources, risks, and rewards, making them a powerful market entry and expansion strategy in Japan.