Introduction

A sole proprietorship, known in Japan as “kojin jigyo” (個人事業), is a business owned and operated by a single individual without any legal distinction between the owner and the business. This structure offers a straightforward and cost-effective way to start a business, ideal for small enterprises and individual entrepreneurs.

Understanding Sole Proprietorship

A sole proprietorship is a business structure where the owner and the business are legally the same entity, meaning there is no separation between personal and business assets and liabilities. This simplicity distinguishes it from other business forms such as Kabushiki Kaisha (KK) and Godo Kaisha (GK). KK is equivalent to a corporation and involves a more complex setup and higher costs, while GK is similar to a limited liability company (LLC) and offers limited liability but also requires more formalities.

Advantages of Sole Proprietorship

One of the primary advantages of a sole proprietorship is its easy and low-cost startup. Compared to corporations, it involves minimal paperwork and setup costs. The tax reporting process is also simplified, with less complex filings and record-keeping requirements. For businesses with lower profits, the tax burden is often lower, providing more favorable tax treatment for smaller incomes. Additionally, the administrative workload is reduced, with fewer formal requirements and ongoing compliance compared to corporations.

Steps to Start a Sole Proprietorship

Filing Your Notification of Commencement of Business

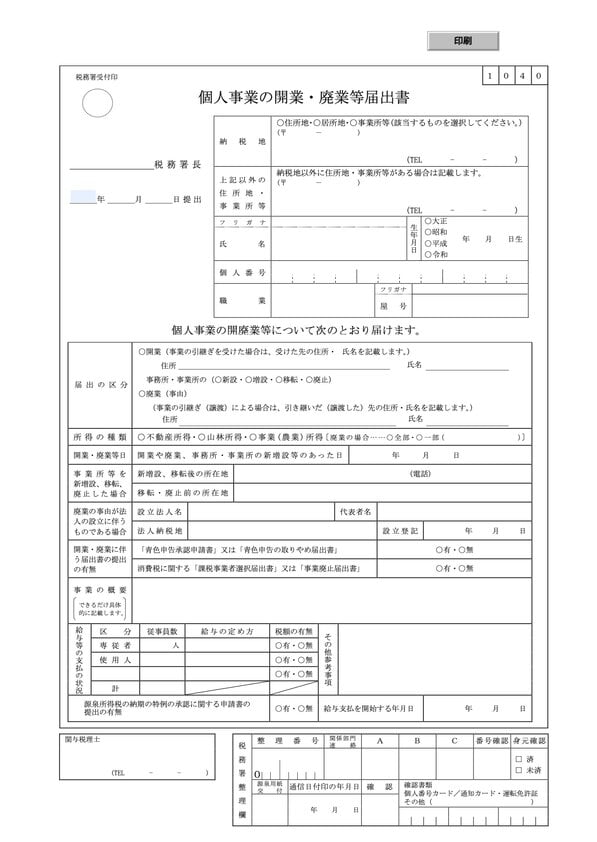

To establish a sole proprietorship, you must file a “Notification of Commencement of Business” (個人事業の開業・廃業等届出書) within 30 days of establishment with the local tax office in the ward or city where the business is located. This essential step ensures that your business is officially recognized for tax purposes.

Filing Your Blue Tax Return Form (青色申告承認申請書)

While not legally mandatory, filing the Blue Tax Return Form can provide significant tax benefits, such as up to 650,000 Yen in tax deductions. This form must be submitted within two months of your business opening or can be filed simultaneously with the opening notification.

Decide on Your “Company Name”

Even though having a trade name is not mandatory for sole proprietorships, it can be beneficial. A trade name can convey the nature of your work and make your business more memorable. However, it is important to note that sole proprietorships cannot include the word “company” in their trade names and should avoid names that are confusingly similar to well-known companies or those that infringe on trademark rights. If you decide on a trade name, it should be included in the business start-up notification, but it can also be chosen after the notification has been submitted.

Obtaining the Necessary Permits/Licenses

Starting a business in Japan requires compliance with various legal regulations, including obtaining the necessary permits and licenses specific to your industry. For instance, if you plan to open a restaurant, you must secure a business license from the public health center (保健所). On the other hand, if you’re entering the recruitment industry, you must report to the prefectural Labor Bureau (都道府県労働局). Each industry has its own set of guidelines and application procedures, which can be found through respective government departments.

Registering with the Post Office

Registering your business with the post office is a critical legal requirement in Japan. This process not only ensures that your business is officially recognized and authorized to operate but also provides you with a unique identification number known as a “Jusho-In.” This number is essential for various administrative and financial activities, such as opening a business bank account, complying with tax laws, and receiving government subsidies. By obtaining this identification number, you formalize your business operations, enabling you to engage in legal and financial transactions seamlessly.

Raising Funds

Securing adequate funding is a crucial step in starting your sole proprietorship. First, you need to estimate your funding needs by predicting industry-specific startup costs and calculating both expenses and sales projections. There are several funding options available in Japan. For instance, the Japan Finance Corporation offers “New Opening Funds” and various government subsidies to support new businesses. Additionally, crowdfunding has emerged as a popular alternative for raising capital. Specialized loan companies also provide financing tailored to startups. To maximize your chances of securing funds, it’s advisable to research typical business costs in your industry and develop effective fundraising strategies that align with your business plan. To learn more about crowdfunding, listen to our podcast.

Opening a Bank Account

Opening a dedicated business bank account is essential for managing your finances efficiently. This practice helps separate your personal and business finances, simplifying tax reporting and ensuring clear transaction records. A dedicated business account also enhances the clarity and professionalism of your financial dealings. Using a trade name for your business account can boost your credibility with partners and customers. In Japan, sole proprietors can easily open accounts under their trade names, which helps improve trust and facilitate business transactions by maintaining a clear distinction between personal and business finances. To learn more about banking in Japan.

Filing for Labor & Social Insurance (If You Have Employees)

If you hire employees, you must complete social insurance procedures in Japan. This involves enrolling your employees in labor insurance, which includes workmen’s accident compensation insurance and employment insurance. You can apply for these insurances at the Labor Standards Inspection Office and the Public Employment Security Office (Hello Work). The required documents may vary depending on where you submit them but typically include a labor insurance relationship establishment notification and a Labor Insurance Estimated Premium Declaration Form. Ensuring your employees are properly insured is a legal requirement and provides them with essential protections and benefits.

Why use a Virtual Office for my Sole Proprietorship Business?

A virtual office offers several advantages for small business owners. It provides a professional image, which can enhance your business’s credibility. Additionally, it offers a cost-efficient business address that you can use for company registration. Virtual offices often include services such as physical mail handling, where your mail can be opened and OCR-scanned at your request, with everything stored in the cloud for easy access. This setup allows you to manage your business correspondence efficiently and maintain a professional presence without the overhead costs associated with a physical office space. Read more on top virtual offices in Japan.

Tax Obligations

Understanding your tax obligations is crucial for the smooth operation of your sole proprietorship. In Japan, sole proprietors must file their annual tax returns (Kakutei Shinkoku) between February 16th and March 15th each year. The types of taxes you need to consider include income tax, resident tax, consumption tax, and individual business tax. Tax rates and deductions vary depending on your income range. For instance, if you opt for Blue Tax declaration status, you can deduct 550,000 yen to 650,000 yen from your taxable income. Additionally, sole proprietors must pay the “kojin jigyo-zei” tax. Accurate and timely tax filing is essential to avoid penalties and ensure compliance with Japanese tax laws.

Conclusion

Starting a sole proprietorship in Japan involves a series of legal, financial, and administrative steps. From obtaining the necessary permits and licenses to registering with the post office, raising funds, and understanding tax obligations, each step is critical for establishing a successful business. Additionally, opening a dedicated business bank account and considering a virtual office can enhance your business operations and professionalism. By carefully planning and adhering to these guidelines, aspiring sole proprietors can lay a solid foundation for their ventures and tackle the challenges of entrepreneurship with confidence.